Lafarge Zambia stock appreciation, a correction triggered by Huaxin M&A deal

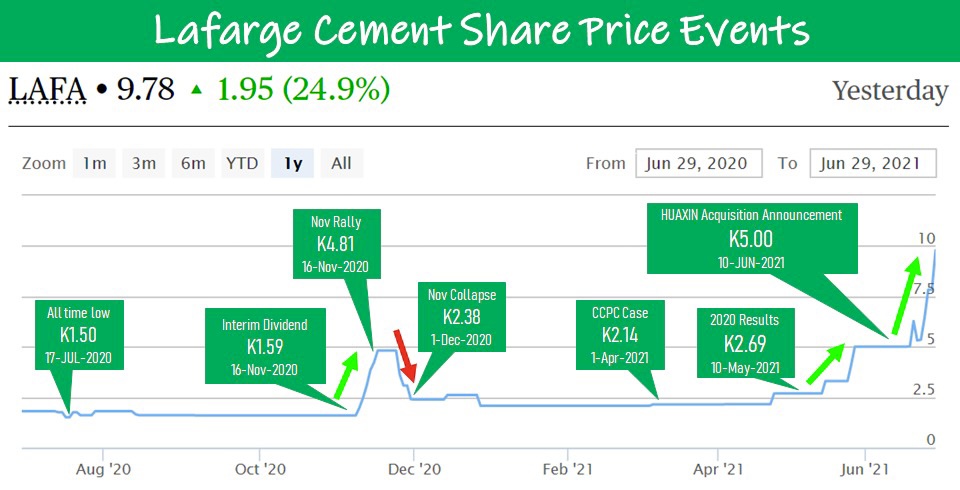

One stock trading actively on the Lusaka Securities Exchange – LuSE that has stolen traders attention is Lafarge Zambia Plc (ZM:ISIN0000000011) that has seen a surge in positive price momentum over the last few weeks. Currently pegged at a market capitalisation of K1.95 billion (circa $87 million) compared to a $150 million enterprise value that Huaxin China will pay for the 75.0% majority stake in Lafarge Zambia, Lafarge stock has rallied 95.0% to K9.78 per share between 18-30 June resulting in a x3.5 amplification in market capitalisation from start of year.

Lafarge Plc alongside 4 other stocks namely Illovo’s subsidiary Zambia Sugar Plc, Real Estate Investment Zambia – REIZ and Zambia National Commercial Bank Plc that have sent the Lusaka Securities Exchange – LuSE All Share Index – LASI to above 4,600 for the first time in 2 years. the ALSI is 9.0% up between 18-30 June, 15.0% for 2Q21 and 18.0% stronger year to date as it extends its recovery from the pandemic year.

Over and above the majority shareholding takeover by Huaxin Investment Company from Financiere Lafarge SAS, and Pan African Cement for an enterprise value of $150 million (circa K3 billion). Current market capitalisation is K50 million shy of two yards the dollar equivalent of $87 million which could potentially fuelling the rally as the investors seek price discovery to hit market equilibrium. Exchange rate risk has eroded market cap value in dollar terms.

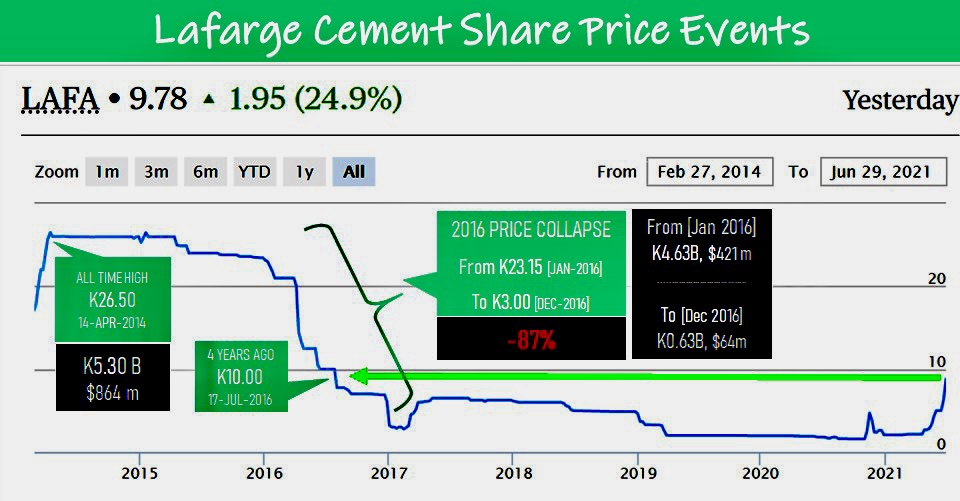

A little trip down memory lane will reveal the cement producers stock hit an all time high of K26.5 per share in April of 2014 when Lafarge was K5 billion (circa $864 million) in market capitalisation terms. With the energy crisis effects prices plummeted to K10 a share in July of 2016 where the price remained suppressed at K3.0 from K23.15 a share in that year representing an 87.0% ebb. In this period Lafarge Zambia shrivelled to K630 million (circa. $64.0 million) in December 2016.

At current (June 30) market price K9.78 ($0.43) per share the stock is still however 42.0% below the proposed enterprise value inferred from the Huaxin Investment Company takeover. Additionally the share price could also be signalling a potential mandatory offer on the horizon given the aggressive momentum in price climb. What the cement stock could be signalling is recovery and correction from the seasonality swings but this time fuelled by the positives surrounding the company. Exchange rate volatility has been another translation driver for the stock.

Other driver of exceptional performance include the successful transformation of Lafarge into an export driven company, export recovery in addition to the entity being debt free. These factors have continued to build a bullish storm around the share price outlook.

Since June 11 (the cautionary announcement date of the Huaxin takeover), 346,118 trades have exchanged hands of which 12.2% were foreign exits in nature and a net out flow of 17,395 whose rally was fuelled by institutional investor sentiment.

The Huaxin Investment Company purchase of 75.0% of Lafarge Zambia Plc stake is still undergoing Securities and Exchange Commission – SEC approval.

76 total views , 1 views today